COMPANY LAW IS THE BACKBONE OF CORPORATE GOVERNANCE

- Corporate or a Corporation is derived from the Latin term “corpus” which means a “body”. Governance means administering the processes and systems placed for satisfying stakeholder expectation. The root of the word Governance is from ‘gubernate’, which means to steer. When combined, Corporate Governance means a set of systems, procedures, policies, practices, standards put in place by a corporate to ensure that relationship with various stakeholders is maintained in transparent and honest manner and business is conducted ethically.

- In General Prudence, Corporate Governance is the system of Rules, regulations, practices and processes by which a Firm/ Company is directed and controlled.

- Corporate governance is the system by which companies are directed and controlled. Boards of directors are responsible for the governance of their companies. The shareholders’ role in governance is to appoint the directors and the auditors and to satisfy themselves that an appropriate governance structure is in place.

- The purpose of corporate governance is to facilitate effective, entrepreneurial, and prudent management that can deliver the long-term success of the company.

- Corporate Governance deals in such a way that the not only the shareholders but other stakeholders of the company also get benefit.

- Corporate Governance in India is a set on internal controls, policy and procedures which form the framework of a company’s operations and its dealings with various stakeholders such as customers, management, employees, government, and industry bodies.

- The framework of such policies should be such as to uphold the principles of transparency, integrity, ethics, and honesty. Corporate Governance is the soul of an organisation and must be adhered to while indulging in any business practises.

- Around 12 Indian companies have featured in the Forbes list of the world’s 2,000 best regarded companies. Infosys, TCS, Tata Motors secured the 31st, 35th and 70th ranks, respectively. There hasn’t been a greater need for good Corporate Governance in India.

- In today’s corporate world, Companies Act,2013 stands as the foundation and bridge between the members, directors, and stakeholders of the Company.

- The corporate governance initiatives for companies in India are primarily taken by the Ministry of Corporate Affairs. The Ministry facilitates the effective implementation of the various provisions of the Companies Act and its other allied laws, rules and regulations which regulate the functioning of the corporate sector in accordance with the law. To promote corporate governance and to crack down on shell and non-functional companies, the Companies Act has been amended to inter alia introduce several corporate governance reforms, such as declaration of significant beneficial ownerships of shares, enhanced disclosure requirements in the reporting made to the shareholders in the annual reports as well as to the authorities. The Companies Act also undergoes amendments from time to time to address the difficulties in compliance and corporate governance by the companies and enhancing the ease of doing business while retaining the overall framework of corporate governance. In March, 2019 Ministry also released a set of guidelines called National Guidelines on Responsible Business Conduct which sets out the basic principles for doing business in India (regardless of the size, sector, entity or ownership of the business).

- The Securities and Exchange Board of India (SEBI) is the authority which regulates the corporate governance of listed companies in India. SEBI published a report on 5 October 2017 (Kotak Committee Report) on strengthening current corporate governance provisions. SEBI has amended the LODR Regulations in 2018 and 2019 to give effect to certain recommendations of the Kotak Committee Report.

- Good Corporate Governance creates transparent rules and provides leadership quality and aligns the interest of stakeholders. Good Corporate Governance defines the long-term success of company. Corporate Governance works in following principle: Fairness, transparency, Risk Management, Responsibility & accountability.

- It has now become established that the company law has been amended many times but the changes which took place in 2013 under company’s act has great importance and the reasons are:

- The concept of One Person Company was introduced. wherein the company is incorporated by a single person and that single person is also the nominee of that company.

- section 135 of this act was amended which deal with the corporate social responsibility as well as company law tribunal and company law appellate tribunal.

- Government introduces Ease of Doing Business Policy & in compliance with EODB, various provisions of Companies act exempted by Private Companies & Small Companies.

- For Better Transparency, Ministry of Corporate Affairs provides features of View Public Documents by paying nominal fee.

- In View of Corporate Governance, Ministry is trying to no interference or very less interference of Public while dealings with corporate laws. Many Forms are approved through Straight Through Processing (STP) Mode.

- To Ensure Corporate Governance, Government has undergone strides changes in Companies Act over the time. Now, Ministry introduces Version 3 MCA Portal for better governance & transparency.

- The Disclosure requirement in the Boards report enable all the stakeholders to know the financial and other strength of the Company.

- The removal of the approval requirement on various matters from the //central Government has given more handy tools to the corporate to management the Company effectively.

- The introduction of Form CSR 1 and Form CSR 2 are the futuristic forms which will enable the stakeholders that the amount being expended is benefiting to the actual beneficiaries.

- The Act has given more freedom to the Private Limited Companies as compared to the Public Limited Companies with less compliance.

- The process of allotment of shares are made vary clear with different options of allotment of shares with different compliances and valuation.

- The Government has also taken to strike off the companies, which are not working.

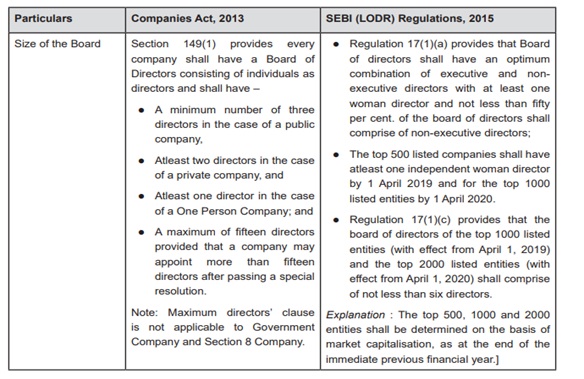

- The Companies Act and the LODR Regulations are the main laws on corporate governance practices of listed companies. Companies Act imposes Certain obligations on companies in interest of upholding corporate governance norms, including the following:

- Composition of Board of Directors;

- Duties of Directors;

- Constitution of Committees;

- Corporate Social Responsibility & Reporting therof;

- KYC Requirement of Board of Directors.

- Unique Director Identification Number Requirement.

- Appointment of Independent Director

- While the members of the company invest in the company by pooling their funds, it is the directors who partake the day-to-day management of the company. It is them who decide where to park the funds invested by the owners, which projects to invest in and how to multiply the retunes on such investments.

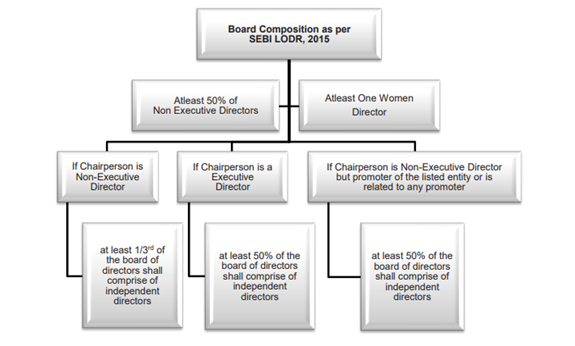

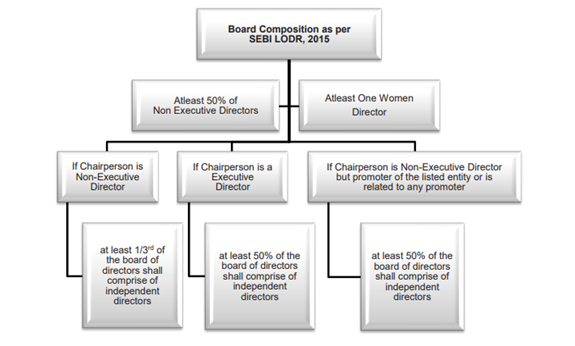

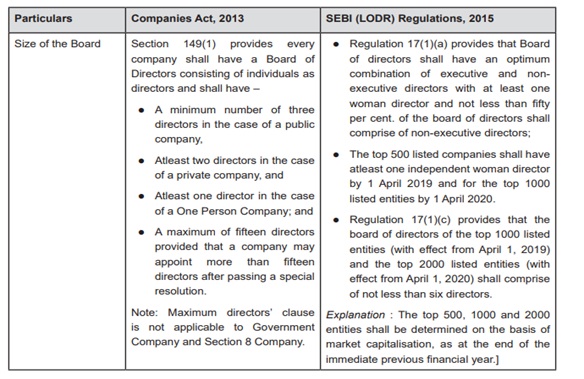

- Thus, Composition of the Board is a crucial determinant of Board effectiveness. It is essential to have a judicial mixture of Executive and Non-Executive Directors to ensure that there is no biasness in the company decision making process.

- The combination of different kinds of director will ensure the maximum expertise, knowledge and experience is brought to the Board that will help in making right and prudent decisions in the company.

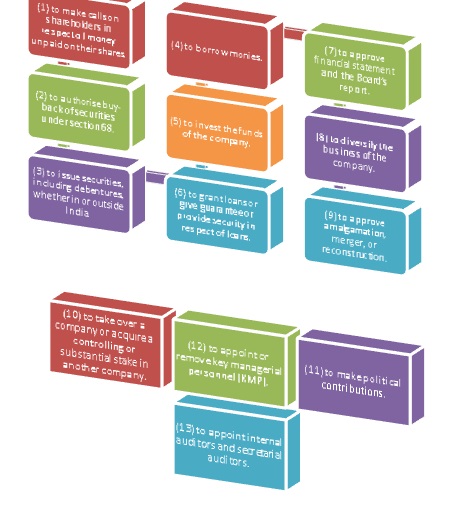

- In terms Section 179 of the Companies Act, 2013 the Board of directors of a company shall be entitled to exercise all such powers, and to do all such acts and things, as the company is authorised to exercise and do.

- The Board shall not exercise any power or do any act or thing which is required, whether by this or any other Act or by the memorandum or articles of the company, to be exercised or done by the company in general meeting.

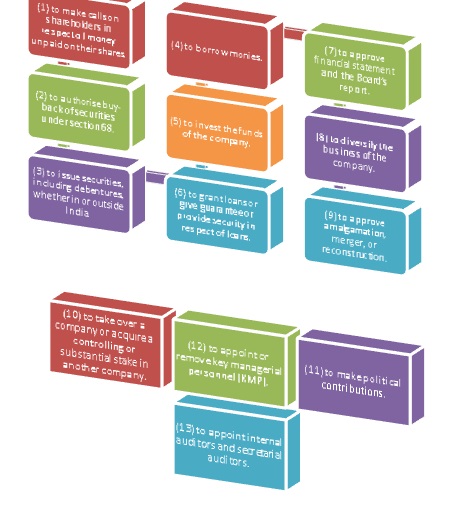

- As per Section 179(3) read with Rule 8 of Companies (Meetings of Board and its Powers) Rules, 2014, the Board of Directors of a company shall exercise the following powers on behalf of the company only by means of resolutions passed at meetings of the Board, namely: –

- The benefits of good corporate governance are brought out by the implementation of the Companies Act, 2013. Its successor acts were riddled with insufficient provisions to meet the demands of corporate world as it has become today.

- A company is not all about just making profits, market valuations, P/E multiples and turnovers, there is a lot that goes into building its position and image. Corporate Governance is one such hidden force. After numerous scandals, maligned reputations and economic downturns, companies are now realising that few concrete steps towards better governance could have saved years of their labour.

- The way the new Companies Act has provided for transparent system of compliance, easy access of the company’s details, working of MCA portal, timely compliance through various support systems, it has strengthened the purpose of the corporate governance.

- The strength of the Companies Act towards the corporate governance is such that it may be said that the Companies Act, is the back bone of the Corporate Governance in today’s scenario.

- The better corporate governance has increased the value of the Indian Companies in the global market and has also increased the trust of the global investors to invest in India.

- Section 180 of the Act imposes restrictions on the powers of the Board. It provides that the board can exercise the following powers only with the consent of the company by special resolution: –

(a) to sell, lease or otherwise dispose of the whole or substantially the whole of the undertaking of the company or where the company owns more than one undertaking, of the whole or substantially the whole of any of such undertakings.

(b) to invest otherwise in trust securities the amount of compensation received by it because of any merger or amalgamation.

(c) to borrow money, where the money to be borrowed, together with the money already borrowed by the company will exceed aggregate of its paid-up share capital and free reserves and securities premium, apart from temporary loans obtained from the company’s bankers in the ordinary course of business.

(d) to remit, or give time for the repayment of, any debt due from a director.

- A board committee is a small working group identified by the board, consisting of board members, for the purpose of supporting the board’s work.

- Committees are generally formed to perform some expertise work and improve board effectiveness and efficiency.

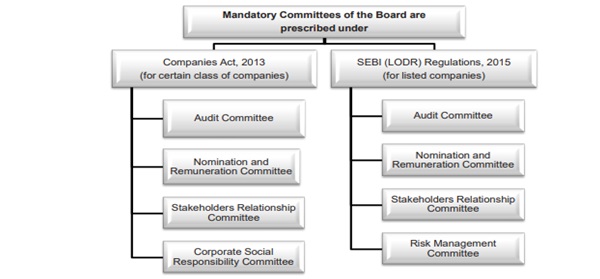

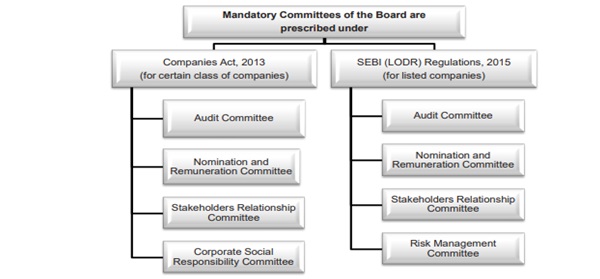

- Companies Act, 2013 requires certain class of companies to form some committees mandatorily. Similarly, SEBI (LODR) Regulations, 2015 makes it mandatory for the listed companies to formulate certain committees of the board.

- Committees thus have an important role which includes –

- To strengthen the governance arrangements of the company and support the Board in the achievement of the strategic objectives of the company.

- To strengthen the role of the Board in strategic decision making and supports the role of non-executive directors in challenging executive management action.

- To maximise the value of the input from non-executive directors, given their limited time commitment.

- To support the Board in fulfilling its role, given the nature and magnitude of the agenda.

It is evident from above that Companies Act plays a vital role in formation of good corporate governance practices. Through this article, we have covered many provisions of Company law that evident the vitality of corporate governance practices.

In Conclusion, we can say Company Law is the backbone of Corporate Governance. As Corporate governance includes rules & regulations for governance of an organisation Companies Act provides various rules & provisions for implementation of good corporate governance practices.

Dr. Ramakant Pathak

FCS, LL.B., CSR Certified Professional

RAMAKANT PATHAK & CO.

SAMPARK & CO.

SAMDANI SHAH & KABRA

(Company Secretaries)